Content

Read our post How To Get the Most Out Of Your Accounting Software This Tax Season to learn which reports to save in case of an audit. QuickBooks Online is overkill for what sole proprietors need and, frankly, it’s not worth the trouble it takes to overcome the learning curve. That’s why most self-employed individuals muddle through with spreadsheets, a folder full of receipts, and a gut feeling about what to set aside for taxes each quarter. • Enable payments and bank transfer services to get paid faster.

This allows freelancers to estimate their taxes throughout the year, for example, so they know how much to set aside each quarter to prepare April 15th. Users can access Quickbooks Self-Employed on their mobile devices remotely as it uses industry-standard encryption technologies to secure communication between stakeholders. Quickbooks Self-Employed services are offered on a monthly subscription basis that includes phone support. The pages are generally simple and clear, ideal for time poor freelancers wanting basic information at a glance. They follow a familiar format of a left hand vertical panel containing navigation links and a large central area for information and data entry. There’s nothing surprising here, but it’s very nicely done, and a match for the likes of Wave, which is also very well designed. You can set expense rules to make categorization even easier, and add receipts.

Mobile Miles, Mobile Apps

The use of rules makes it possible to categorize things like Schedule C expenses and home-office costs. In general, we recommend QuickBooks Online over QuickBooks Self-Employed, even for freelancers. QuickBooks Online costs more, but it also offers more thorough invoicing and additional insight into your cash flow. It also connects to Shopify and automatically adds sales tax to your invoices, two crucial features for sole proprietors who sell products online. Like QuickBooks Online, QuickBooks Self Employed requires a live Internet connection to use at all.

100% accurate calculations and your maximum refund, guaranteed. Massage Book This all-in-one practice management tool will help you simplify and grow your practice. Massage Warehouse Save up to 30% at Massage Warehouse plus pay only $4.99 shipping on supply and equipment orders. Well, now it meet the needs of accountants and self-employed workers, as Intuit seamlessly is integrating QuickBooks Self-Employed and QuickBooks Online Accountant. Stay updated on the latest products and services anytime anywhere. Patriot Payroll vs. Gusto Payroll 2021 Gusto and Patriot Software are two of the best payroll software picks for small businesses…. When you first sign up, you can choose between QuickBooks’ 30-day free trial or a three-month discount, usually between 50% and 70%.

no Recurring Transactions

You can upgrade to QuickBooks Online but may need to manually move your data. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. Here is a list of our partners and here’s how we make money. You can record business trip mileage automatically or manually and let Intuit QuickBooks Self-Employed calculate your tax deduction.

quickbooks/intuit for self-employed – it costs a little money but it is very worth it so far. you can just click on what your expenses are and it calculates that, your taxes to pay for income and shows profit/loss

— Lorie Liebig (@lorieliebig) November 30, 2021

The next step up from Intuit QuickBooks Self-Employed is Intuit QuickBooks Online, which is our Editors’ Choice winner for small business accounting again this year. It offers much more in every possible way, while maintaining the same exceptional user experience found in its more junior version. Ideally, QuickBooks Self-Employed is very helpful for business proprietors who do not discriminate between personal and business accounts. If you have an account that meets all your income and expenses, QuickBooks Self-Employed can help you very smartly. In his words “Quickbooks Self-Employed does a great job in allowing me to follow my expenses.

Comprehensive Mobile App

That is understandable, because, unlike other versions of QuickBooks, checks, payments and deposits are not meant to be added manually to the system. This product simply categorizes the transactions it imports from your bank and and credit card accounts. If you are a freelancer or solopreneur with no employees or contractors, QuickBooks Self-Employed was made for you.

QuickBooks Time Automated time tracking to help your firm and clients simplify payroll. Bundle includes the cost for only one state and one federal tax filing. Each additional TurboTax Self-Employed federal tax filing is $119.99 and state tax filing is $44.99. Each additional TurboTax Live Self-Employed federal tax filing is $199.99 and includes live on screen tax advice from a CPA or EA, and state tax filing is $44.99. Our team will give your business the right support that it needs to eliminate errors, ensure success and save some serious money.

- Strong reporting, customizable invoices, inventory capabilities, and multiple currencies.

- You can enter start and end addresses and let Intuit QuickBooks Self-Employed calculate the miles or simply enter the miles driven yourself.

- This version is available in three plans, and you can choose according to your budget.

- QuickBooks Self Employed also has a tab for taxes where it shows your quarterly and annual estimated taxes.

- Invoicing can sometimes be a complex process with many opportunities for something to slip through the cracks.

- If you’d prefer to test out the software before you commit, you also have the option for a 30-day free trial.

- Stacy Kildal is owner/operator of Kildal Services LLC—an accounting and technology consulting company that specializes in all things QuickBooks.

QuickBooks Self-Employed has a newly-designed dashboard that is easy to navigate. It displays six charts that give you an instant view of your financial data. The tabs on the left side of the dashboard make it easy to explore the other features. Overall it is intuitive and not cluttered with unnecessary information, making it approachable for accounting novices. Using the QuickBooks Self-Employed app, quickly mark income and expenses as business or personal with the swipe of your finger. You also can split transactions by percentage or dollar amount, designating a portion as business versus personal. One advantage of using an Intuit solution, though, is that you can upgrade to an application that’s more sophisticated while staying in the same product family.

Tracking Payments To Vendors & Inventory

There’s also built-in support if you need extra help setting up and navigating the software. When you work for yourself, your top priority is ensuring that you’re balancing your budget every month.

Intuit Commits to Helping 1 Million US Small Businesses Cut Emissions in Half By 2030 – Yahoo Finance

Intuit Commits to Helping 1 Million US Small Businesses Cut Emissions in Half By 2030.

Posted: Tue, 02 Nov 2021 07:00:00 GMT [source]

You can also manually enter trips using the app or web service. But if you’re mixing business and pleasure, financially speaking, you’ll appreciate intuitive tools to help you track, sort and categorize transactions. The QuickBooks Self-Employed mobile companion apps works with iPhone, iPad, and Android phones and tablets. Not all features are available intuit quickbooks self employed on the mobile apps and mobile browser. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. This version of Quickbooks is designed to help you record your self-employed income and expenses, track mileage, and prepare your Schedule C.

Lets Discuss Some More Issues With Quickbooks Self

As cloud-based software, QuickBooks Self-Employed is compatible with nearly any computer that has an internet connection. QuickBooks Self-Employed also has mobile apps available for Apple products (iOS 13.0+) and Androids (6.0+). Small Business Computing addresses the technology needs of small businesses. If you drive for business reasons, you can deduct a standard rate per mile or actual vehicle expenses. QuickBooks Self-Employed has a mileage tracker app that you can download on your Android or iOS phone.

Intuit Reports Strong First Quarter Results and Raises Full Year Revenue Guidance Reflecting Early Momentum in the Year and the Acquisition of Mailchimp – Business Wire

Intuit Reports Strong First Quarter Results and Raises Full Year Revenue Guidance Reflecting Early Momentum in the Year and the Acquisition of Mailchimp.View Full Coverage on Google News

Posted: Thu, 18 Nov 2021 21:00:00 GMT [source]

So if spending less time on exporting is your main concern, this could be a good solution. But if your main concern is Turbo Tax support, it’s important to know that while other software does offer tax support, QuickBooks Self-Employed is the only software that integrates directly with TurboTax. Ultimately, I would think of which feature is most important to you and I’d choose a solution from there. Intuit QuickBooks Self-Employed’s mobile app lacks little—if anything—found on the browser-based version.

Once the transactions are in QuickBooks, you simply go through each transaction and label it as either personal or business and apply the appropriate category to the business transactions. You also have the ability to manually enter transactions that aren’t in your accounts for one reason or another . The website also has a section for tracking miles driven for work, which can be a very important tax deduction. All of these features are also available using the QuickBooks Self Employed mobile app. Intuit QuickBooks Self-Employed provides small businesses with leading financial management tools to help them run their day-to-day activities. Track your income and expenses year round and estimate quarterly taxes with Cash Back at Rakuten on QuickBooks Self-Employed.

- It also points out things you may want to address, transactions to review, and deductions to be aware of.

- QuickBooks Self-Employed is for freelancers and those participating in the gig economy.

- QBSE syncs with all the major banks and online savings accounts like CIT Bank, Discover as well as PayPal, and other credit card accounts.

- But over the course of the last few years, it noticed that there is a large and growing group of freelancers, whose tax situation is often complicated and who have to meticulously track all of their expenses.

Whether you’re ready to freelance fantastically or manage your latest entrepreneurial endeavor, QuickBooks Self-Employed coupon codes and free tutorials let you simplify the business of life for less. But it’s also great for any size of business that works with sites like PayPal and Etsy. While it may seem obvious, QuickBooks Self-Employed really is catered towards the self-employed contractor, freelancer, and small business owners.

If you didn’t set up your Tax Profile initially, click the gear icon, then Tax profile to do so. In this window, you provide some important personal details so the service calculates your estimated taxes correctly. A small link marked Add Rule appears once you select a category. Click it, and a small window opens, helping you to easily teach the site how to categorize similar transactions whenever they appear. You can even have the rule apply to past transactions, which is unusual in this class of applications.

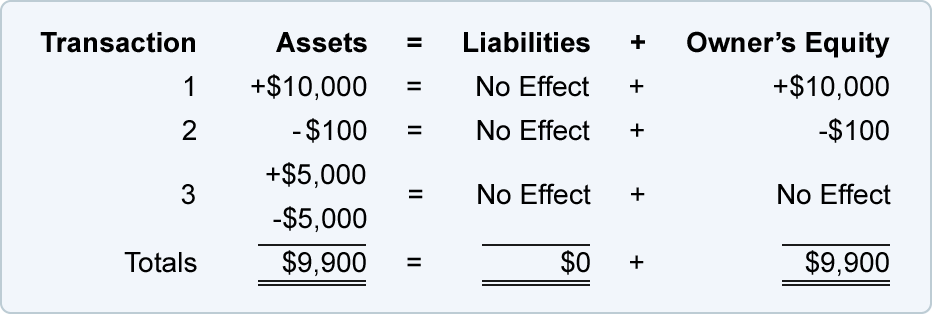

QuickBooks Self-Employed is also an important tool if you’re looking to keep better track of your finances overall. If you are ready to ditch that Excel spreadsheet and get your income and expenses organized, sign up and receive 50% off the first three months. QuickBooks Self-Employed allows you to classify income and expenses using categories that align with the IRS Schedule C, such as utilities, legal fees, and commissions. Once this information is entered, you can view and print a summary of your taxable income and expenses, which can take out some of the guesswork when filing your taxes. If your plan doesn’t include the Tax Bundle, you can use this summary to input your Schedule C information into a tax program of your choice manually. For example, if you pay your personal mortgage or rent from your business checking account, those transactions will be downloaded automatically into QuickBooks Self-Employed with your banking activity.

In other words, if you’re selling products rather than services, we don’t recommend QuickBooks Self-Employed. Finally, most self-employed workers are required to file quarterly estimated taxes. Predicting your own taxes based on an annual income you haven’t yet earned is hard, to say the least. Reconciling is the biggest reason I encourage you not to use QuickBooks Self-Employed for your Photography business. Without a reconciliation process, there’s no way to ensure every transaction has been accounted for and nothing is duplicated. Reconciling accounts is a monthly bookkeeping task you CANNOT do in Quickbooks Self Employed.

Is QuickBooks worth it for small business?

QuickBooks Online is the best overall accounting software for small businesses of those reviewed. Not only do the majority of small business accounting professionals use QuickBooks Online, but there are also endless online training resources and forums to get support when needed.

QuickBooks’ invoicing capabilities are particularly lacking—which is a huge issue for a freelance-focused product. You can send invoices, but you can’t customize them, set recurring invoices, or schedule automatic late payment reminders. However, this software does lack some accounting tools and room for growth, so business owners may want to consider a QuickBooks alternative. And if you’re still unsure, you can always sign up for a free trial and test the platform out for yourself. Within the “trips” or “miles” section of the software, you can automatically track your mileage.

Through this dashboard, you can quickly see the state of your credit and bank accounts, expenses, and profit and loss statement. You can click on any of these reports to get more information. Moreover, the software sorts out any personal expenses, so you can easily separate your business financials and data. The home dashboard is extremely user-friendly and intuitive.

quickbooks/intuit for self-employed – it costs a little money but it is very worth it so far. you can just click on what your expenses are and it calculates that, your taxes to pay for income and shows profit/loss

— Lorie Liebig (@lorieliebig) November 30, 2021

There is no sales tax on invoices, no estimates feature, and — the big one — no state tax support. Ultimately, QuickBooks Self-Employed has not yet delivered on the promise of being a “complete” freelance tax solution. However, it can still be a good freelancing tool for some individuals. With the mid-range QBSE Tax Bundle edition, you also have the option to pay your quarterly taxes directly from QuickBooks and transfer all of your information to TurboTax when tax season rolls around.

Author: Edward Mendlowitz